At RightShip, we are committed to a zero-harm maritime industry and, as an organisation, we see our role as setting global benchmarks to support others to reach this aim too. Actively incorporating Environmental, Social and Governance (ESG) metrics spanning marine emissions, marine pollution, crew welfare and ship safety into the solutions we offer are all critical parts of this vision.

With this in mind, we recently conducted research aimed at ship managers, owners, charterers, ports and those in the finance sector to try and identify the specific factors they see as key ESG issues – and what we can do to help them measure the impact of driving change in these areas.

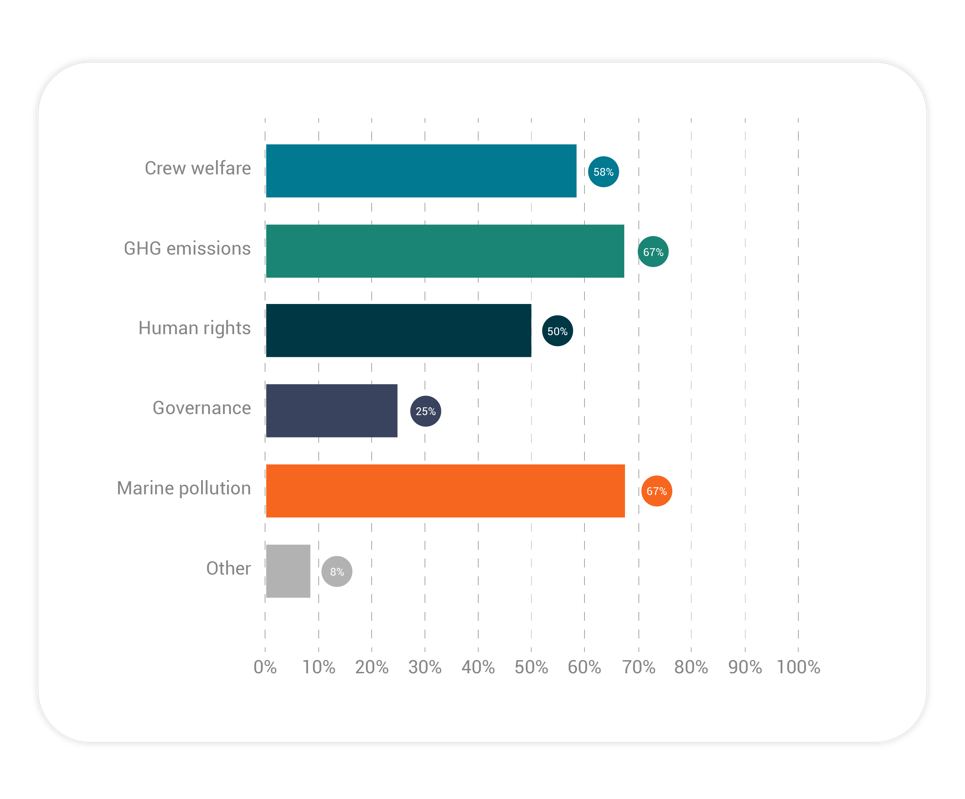

Chart 1 – showing the ESG issues that matter most to the maritime sector. Respondents could select all applicable options

Further interesting results showed that around half of the respondents do not have a dedicated ESG or Sustainability team. This immediately places a weight of responsibility on the shoulders of someone who may not be familiar with the challenges of quantifying ESG.

Unlike the highly developed world of traditional risk measurement, ESG evaluations are still evolving and are famously hard to pin down due to their subjectivity and the advances continually being made in the field of sustainability. What gives you ‘Brownie points’ one week may have already moved on by the time you make the decision to invest. Broad ambitions like those set by the UN Sustainable Development Goals (SDGs) can more readily be slotted into a business model than mandated or financial requirements.

Understandably, this can mean that some people are waiting - hedging their bets before they make changes to their fleet or begin collating data - and others might simply be avoiding the issue, as it’s just too enormous to cope with when viewed collectively.

Why is ESG so intimidating – and how can we make it less so?

The industry has moved on from asking ‘What is ESG?’, to ‘What are the challenges involved in reporting ESG?’ but this still appears to be an overwhelming question for many. Breaking ESG down into manageable sections, through formulation of specific ‘Key Performance Indicators’ (KPIs), could help reduce this anxiety.

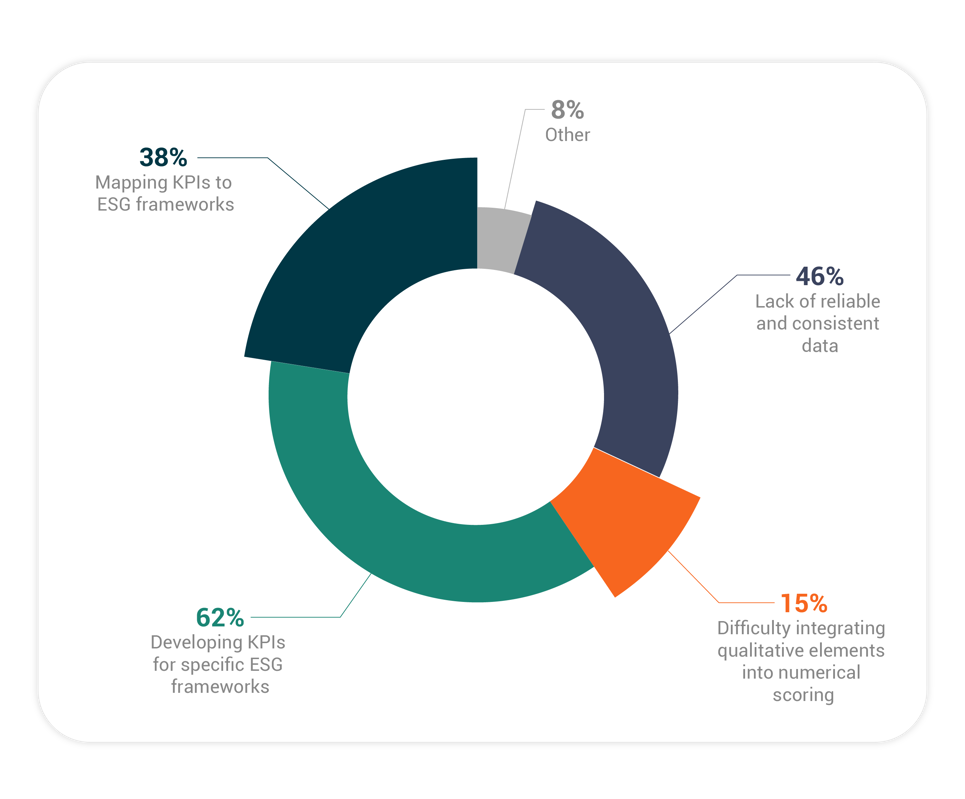

In our research, the key deterrents to transparent ESG reporting were identified as:

- a lack of consistent data,

- formulating KPIs, and

- mapping KPIs to ESG frameworks

Chart 2 – shows the top issues facing those required to report on ESG factors. Respondents could select all applicable options

ESG remains a qualitative add-on for most respondents, with only a third confirming that they have clear KPIs used to report or measure ESG performance.

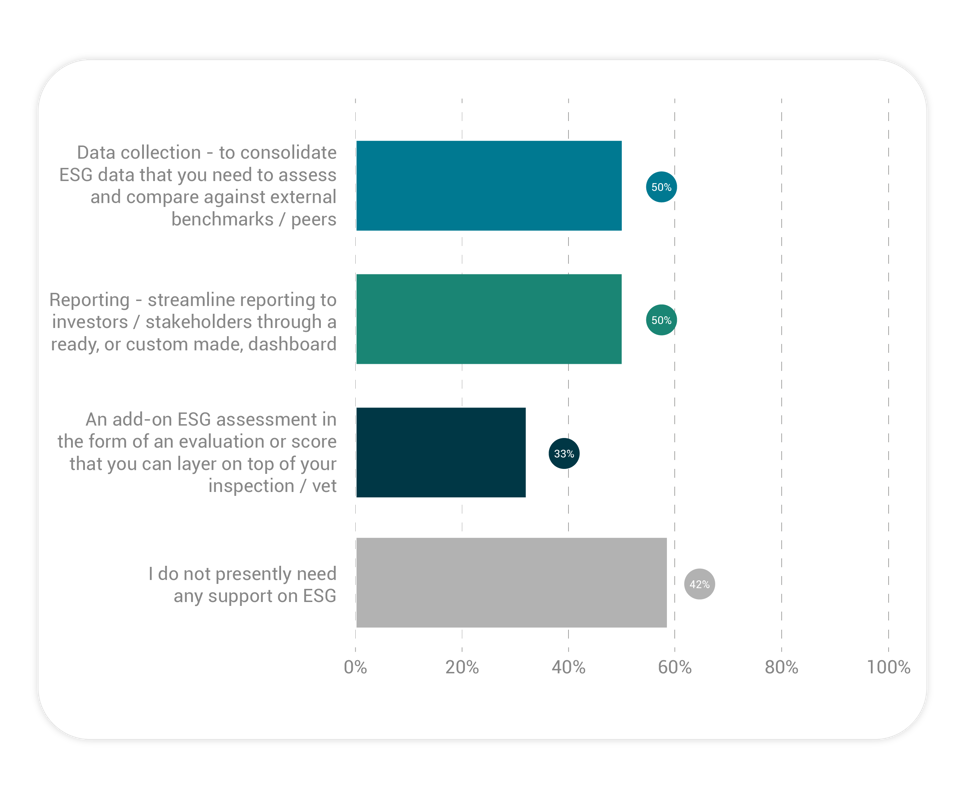

It’s clear that many maritime participants are looking for help with both reporting as well as ESG evaluations.

How can we help?

RightShip’s origins lie in safety – more than twenty years ago, we were formed to ensure vessels were vetted and inspected to the highest standards, to go further in ensuring the wellbeing of those sailing onboard and the cargos being carried.

In recent years, we’ve expanded that aim - not just making sure ships are safer, but that harm is reduced for crew and ultimately the planet too. We offer Safety Scores - rating the safety of a vessel, and post-incident inspections for older vessels - these fall into the ‘G’ of ESG, supporting owners and managers to meet ever-shifting regulatory requirements.

Chart 3 – shows the type of ESG support needed by respondents. Respondents could select all applicable options

We also offer a greenhouse gas (GHG) Rating to track emissions, and Carbon Accounting, allowing charterers and owners to ‘add up’ the impact of a voyage - a solution extended to those managing ports and terminals too, through our Maritime Emissions Portal.

Finally, in recent years we’ve teamed up with leading like-minded organisations such as the Sustainable Shipping Initiative, Mission to Seafarers and Institute for Human and Rights and Business, creating a Code of Conduct setting out standards in how ship’s crew should be treated. Our accompanying Crew Welfare Assessment encourages owners and managers to put themselves forward as leaders going above and beyond to make sure their people are well-treated and happy at sea.

An ever-changing picture

We know that maritime needs to progress in ESG reporting. Encouragingly, our research shows a willingness to change and seek support, even if respondents are not certain what that involves.

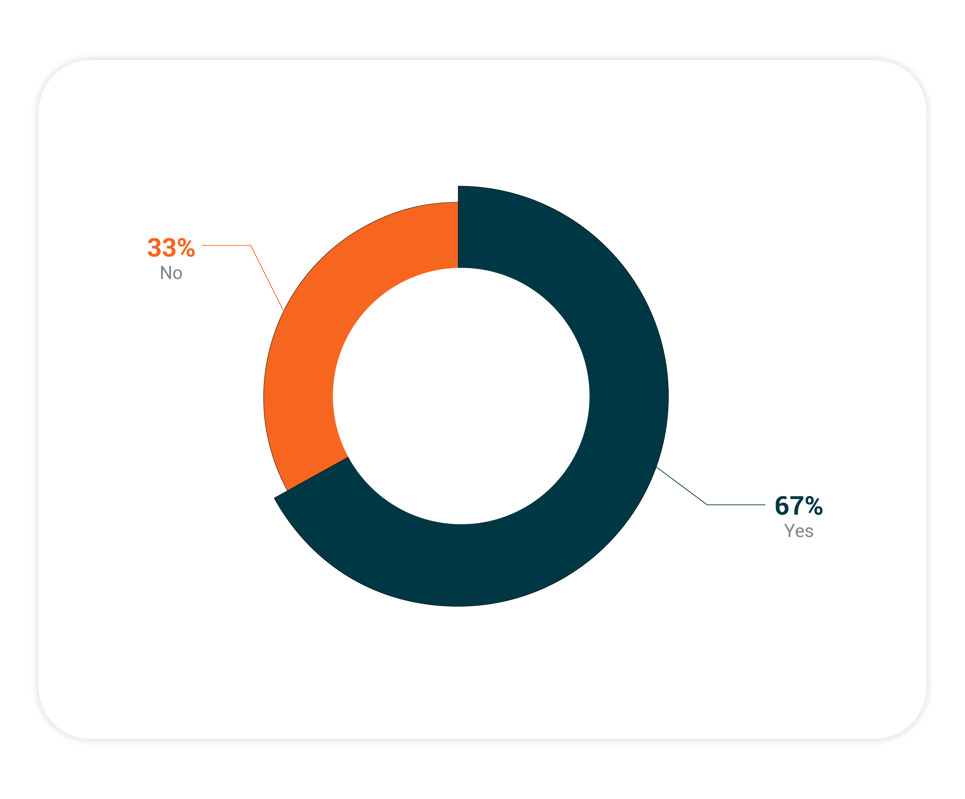

– Is the maritime sector looking for support in creating ESG reports?

Collaboration among all maritime participants will be key in achieving decarbonisation and ESG goals for the sector. We continue to welcome responses to our research here.

If you’d like to discuss your thoughts on the evolving ESG landscape in maritime or understand which aspects of your ESG journey RightShip can support you with, please get in touch.