GHG Rating

GHG Rating

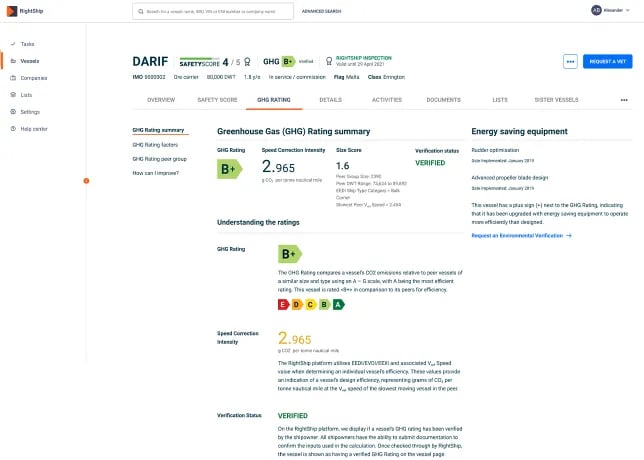

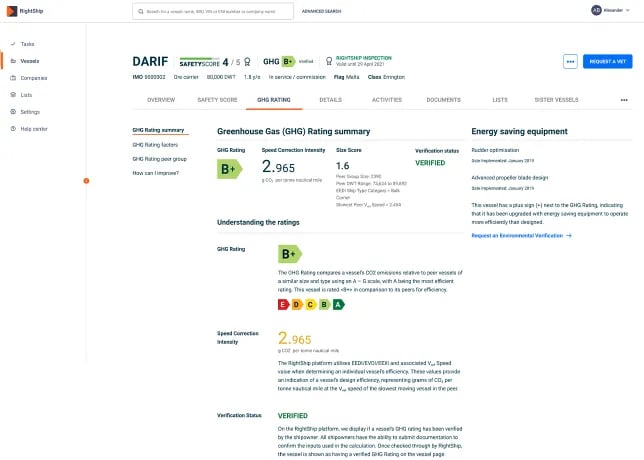

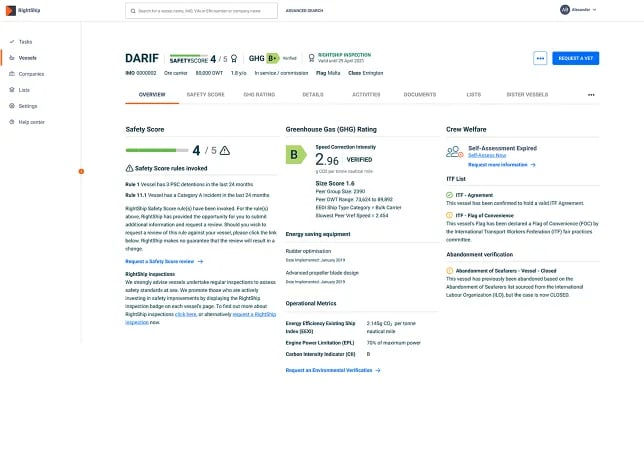

RightShip’s GHG Rating rates the emissions output of commercial vessels on a scale from A (most efficient) to E (least efficient). The gold standard for emissions comparison in the shipping industry, it is the first rating to incorporate EEXI values alongside EVDI and EEDI. It works by calculating and comparing a vessel’s designed efficiency against peer vessels of similar size and type using a speed-corrected methodology.

Financial institutions are under increasing pressure to measure and reduce the emissions associated with their portfolios. The GHG rating gives users a quick and easy way to check the relative efficiency of a vessel, its efficiency upgrades, and the energy efficiency investment history of an owner in one easy-to-understand metric.

Get started

As the trend towards sustainable investment grows, financial institutions are increasingly factoring sustainability into their lending criteria. Join RightShip today and start using our GHG Rating to minimise or mitigate lending risk and develop more sustainable practices.

GHG Rating features

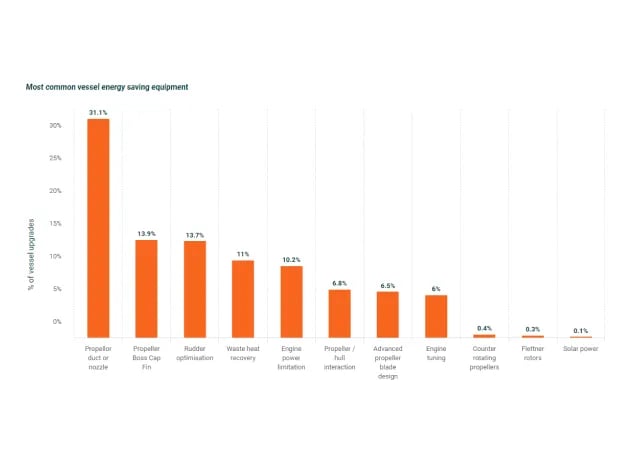

The GHG Rating takes inputs from IMO standards, regulatory indices, and public, third-party, and proprietary data sources to allow best practice environmental vessel selection processes.

Speak the same language as your customers and suppliers by using the GHG Rating, easily understood and used by all players in the industry to decarbonise their supply chain.

Quickly identify vessels standing out from others in their peer group through global and fleet wide benchmarking, and develop strategies to attract the most energy efficient vessels that will improve the emissions profile of your portfolio.

When it comes to safety, quality and environmental performance benchmarking, the only comprehensive tool a ship operator has is RightShip. It is vital for us to measure and compare our results. Apart from benchmarking, the live feed of incidents on the tasks menu contains important lessons learnt from across the industry which are always included in our safety bulletins! We are proud to work with RightShip in an effort to improve the safety and environmental sustainability of the maritime industry.

Blue Planet Shipping Ltd

Previously, our Scope 3 emissions were estimated, but that’s no longer good enough. We need to understand our emissions so we can benchmark them against other shippers and control them effectively. RightShip allows us to do that.

BHP

The data RightShip provides is so critical for us – a trusted source of information and an integral part of our accounting process. MEP has enabled us to communicate confidently and transparently, and we’d encourage others to get on board and do the same.

GeelongPort

GHG Rating advantages

ESG Reporting

Set yourself up for Environmental, Social and Governance (ESG) reporting success by using RightShip’s GHG Rating as a standard framework for measuring the efficiency of an investment portfolio and the ability to track changes over time.

Better returns

Ensure high earning potential of a vessel before you invest by using the GHG Rating to map the correlation between investment risk and vessel employment. An energy efficient vessel has lower fuel costs and better chartering potential, which may lead to a higher initial asset value and a longer period of economic depreciation.

Smooth compliance process

Speed up in credit-approval processes for vessel purchases and sustainable finance assessments for retrofit projects, and use the GHG Rating as a key indicator for a vessel’s profitability.

Get started

Learn more about our solutions, book a demonstration or speak with one of our experts